33+ Louisiana Income Tax Calculator

Web Calculate your Property Taxes. Web How your income is taxed gets broken down into three tax brackets.

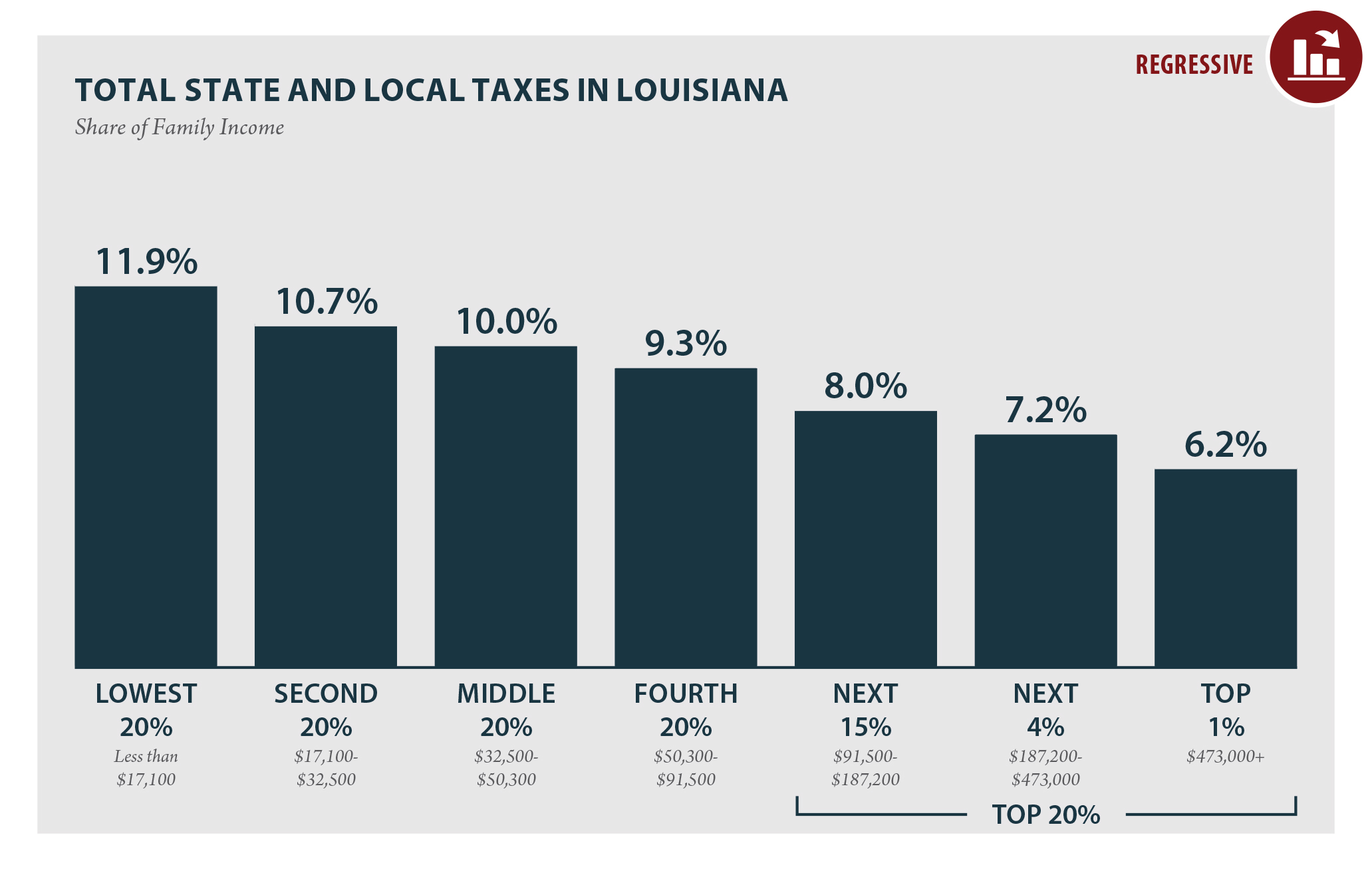

Louisiana Who Pays 6th Edition Itep

Web Louisiana Salary Paycheck Calculator Calculate your Louisiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Louisiana paycheck calculator.

. Your average tax rate is 1167 and your. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 63000 Federal Income Tax - 6628 State Income Tax - 2096 Social Security - 3906 Medicare - 914 Total tax - 13544 Net pay 49456 Marginal. If you make 55000 a year living in the region of Louisiana USA you will be taxed 10832.

Web The total amount of federal taxes you will pay will be 4868. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. State taxable income State tax rate State tax liability.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. 1250001 - 5000000. 5000001 - and above.

000 - 1250000. Web Tax Calculator Instructions The Louisiana Tax Calculator Estimate Your Federal and Louisiana Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow er C3 Number of Dependents C4 Annual Income C5 Annual Federal Deductions Credits. This paycheck calculator can help estimate your take home pay and your average income tax rate.

Web The state income tax rate in Louisiana is progressive and ranges from 185 to 425 while federal income tax rates range from 10 to 37 depending on your income. Web Wisconsin Income Tax Calculator 2022-2023. Louisiana State Personal Income Tax Rates and Thresholds in 2024.

Enter your income and location to estimate your tax burden. Use our paycheck tax calculator. 055 average effective rate.

Enter your details to estimate your salary after tax. If you make 70000 a year living in Wisconsin you will be taxed 10908. Your average tax rate is 197 and your marginal tax rate is 339.

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Enter your info to see your take home pay. Web Louisiana Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Web Use ADPs Louisiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Louisiana has three state. Details of the personal income tax rates used in the 2024 Louisiana State Calculator are published below the calculator.

Web Louisiana Salary Tax Calculator for the Tax Year 202324. The total amount of social security and Medicare taxes will be 3410 and 798 respectively. Switch to hourly calculator Louisiana paycheck FAQs Louisiana payroll State Date State Louisiana.

Gross income Retirement contributions Adjusted gross income. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web The total taxes deducted for a single filer are 77744 monthly or 35882 bi-weekly.

Overview of Louisiana Taxes. 20 cents per gallon of regular gasoline and diesel. Web Use our income tax calculator to estimate how much youll owe in taxes.

Web The Louisiana tax tables here contain the various elements that are used in the Louisiana Tax Calculators. Web 2 tax on 13000 25000 - 12000 26000 4 tax on 25000 100000 6 tax on 35625 213750 --------- 339800 rounded. In addition to this you will pay 1756 as a state income tax in Louisiana.

Enter your income and other filing details to find out your tax burden for the year. Web Louisiana State Tax Quick Facts. Web You can quickly estimate your Louisiana State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Louisiana and for quickly estimating your tax commitments in 2024.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Calculate your federal state and local taxes for the current filing year with our free income tax calculator. Adjusted gross income Itemized deductions Exemptions State taxable income.

10 for the first 11000 of your income which comes down to 1100 12 for any income between 11001 to 44725 33724. Web You can use our free Louisiana income tax calculator to get a good estimate of what your tax liability will be come April. Updated on Dec 05 2023.

That means that your net pay will be 44168 per year or 3681 per month. Web Use our income tax calculator to find out what your take home pay will be in Louisiana for the tax year. Web The Louisiana Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Louisiana State Income Tax Rates and Thresholds in 2024.

Web Income tax calculator Louisiana Find out how much your salary is after tax Enter your gross income Per Where do you work. Free tool to calculate your hourly and salary income after federal state and local taxes in Louisiana. You are able to use our Louisiana State Tax Calculator to calculate your total tax costs in the tax year 202324.

Web Calculate your Louisiana state income tax with the following six steps. As an employee you will pay 10832 in tax in a year. Determine your filing status.

October 2022 Component Manufacturing Advertiser Magazine By Component Manufacturing Advertiser Issuu

Louisiana Tax Rate La Income Tax Calculator Community Tax

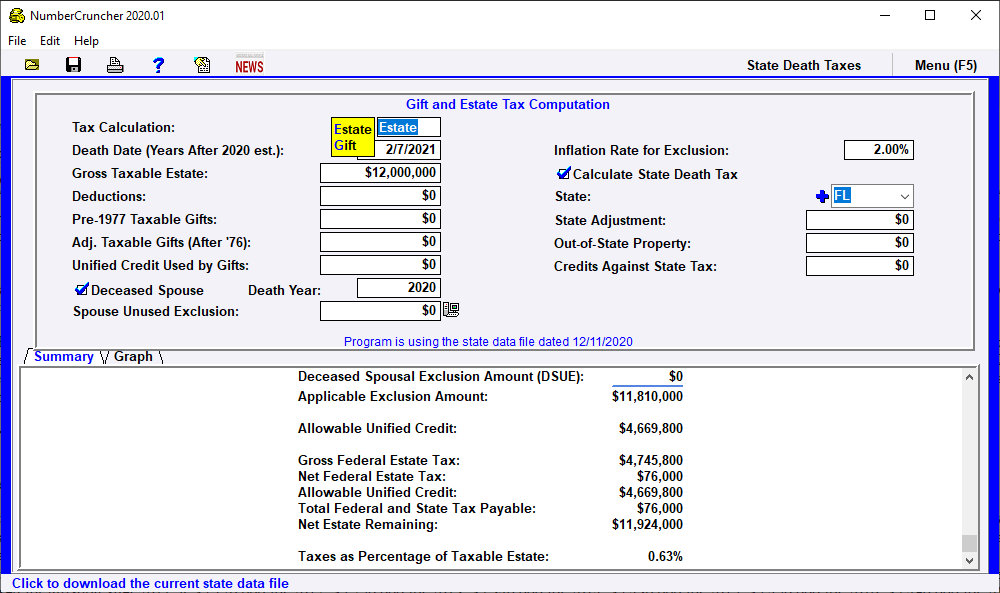

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

Current Issue Federal Public Defender For The Central District Of

Louisiana Scholarships Scholarship For Louisiana Students Plexuss

T14 0106 Decrease 33 Percent Individual Income Tax Rate To 32 Percent Baseline Current Law Distribution Of Federal Tax Change By Expanded Cash Income Percentile 2015 Tax Policy Center

Thinking Clearly About Louisiana Tax Policy Louisiana Budget Project

.png?width=600&height=300&name=TAX%20RATE%20(2).png)

8 Most Popular Self Filing Tax Services Reviewed And Ready For Use

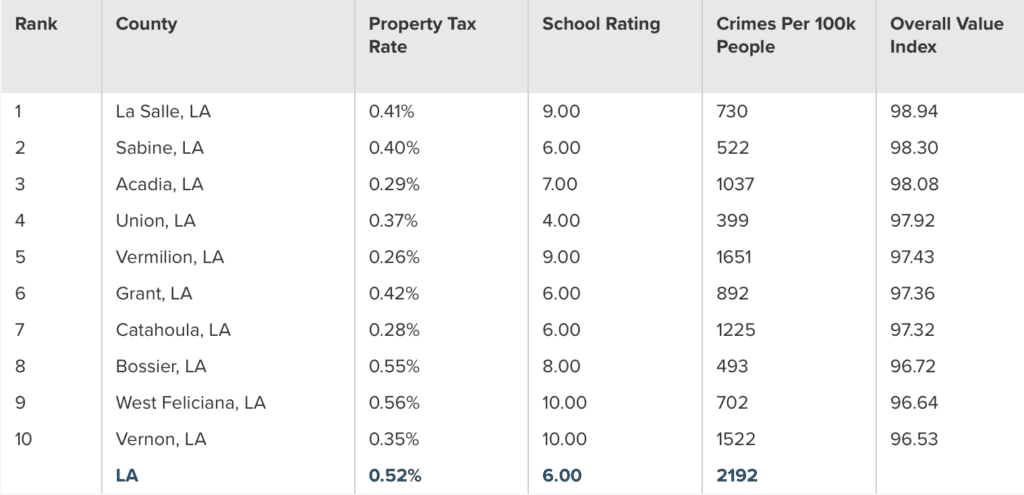

Acadia Parish Ranks Third In Louisiana Where Homeowners Get Most Value For Property Taxes

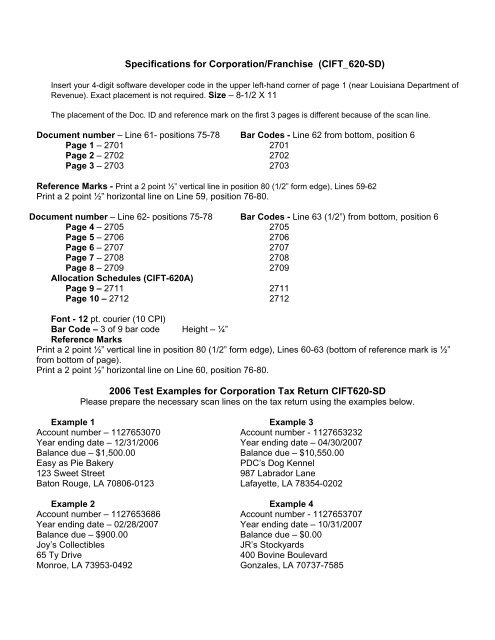

Cift 620 Sd Louisiana Department Of Revenue

1 3m Scotch Super 33 Vinyl Electrical Tape With Non Thermosetting Rubber Adhesive Black 1 Wide X 36 Yd Roll Electrowind

Download Genome Biology And Evolution

Why Are Democrats On Quora Referred To As Demorats And Republicans Referred To As Magats What Even Is A Magat Or A Demorat Quora

What Is The Most Expensive Sushi Bar In Tokyo Japan How Much Would A Meal Cost For Two People Quora

Antioxidants Properties Of Spices Biotau Website Page 1 589 Flip Pdf Online Pubhtml5

Louisiana Tax Calculator 2023 2024 Tax Calculator

What Software Libraries Are Best For Building Monte Carlo Methods Quora